Q&A

-

Castor, both abroad and in France, is the VINCI group’s save-as-you-earn scheme that wherever possible aims to offer employees who so wish the option of becoming VINCI shareholders on more favourable terms.

VINCI’s aim is to share the benefits of its performance and reinforce the sense of belonging to the VINCI group.

-

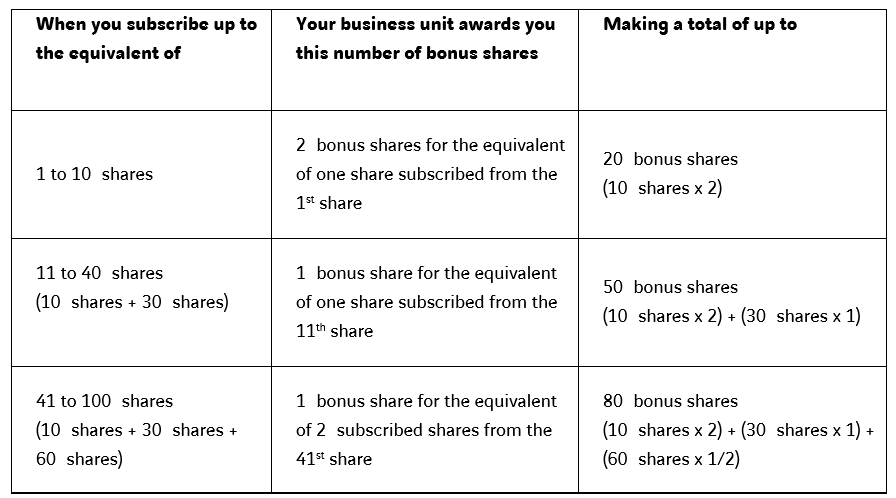

A. The employers contribution in the form of up to 80 VINCI bonus shares.

VINCI supports your effort to save by awarding you a variable number of bonus shares depending on how much you invest. The established rule favours small investors: 20 bonus shares are awarded for the equivalent of the first 10 subscribed shares.

Employees acquire full ownership of these bonus shares three years after their investment, provided they are still employed by their company.

B. Dividends paid out by VINCI

You are entitled to any dividends paid out by VINCI, from the outset on the subscribed shares, and on the bonus shares after three years.

As a shareholder you are paid these dividends twice a year. They are reinvested in VINCI shares and credited to your CASTOR account.C. Your employer bears the cost of the account management fees

As a shareholder you do not bear the cost of the account management fees or the initiation fees, which are paid by your company.

When you leave your company (with the exception of retirement) and keep your shares, you are charged for these fees, which are deducted directly from your holdings.

-

All employees of a company that has joined the group’s international shareholders savings plan (PEGAI) and who have been a company employee for at least 6 months (consecutive or otherwise) during the previous 12 months on the date of their subscription.

-

Barring special cases, they are companies in which VINCI holds more than a 50% stake in one of the countries qualifying for the offer.

-

To date, the countries covered by Castor International include:

Australia, Austria, Bahrain, Belgium, Brazil, Cambodia, Cameroon, Canada, Chile, Colombia, Croatia, Czech Republic, Denmark, the Dominican Republic, Finland, Germany, Greece, Hong Kong, Hungary, Indonesia,Ireland, Italy, Ivory Coast, Lithuania, Luxembourg, Malaysia, Mexico, Morocco, the Netherlands, New Zealand, Norway, Peru, Poland, Portugal, Romania, Senegal, Singapore, Slovakia, Spain, Sweden, Switzerland, the United Arab Emirates, the United Kingdom and the United States.

-

There are two solutions, depending on the country:

– sign up online

To that end, your employer must have entered your e-mail address so that your user ID and password can be e-mailed to you;

– fill in the paper subscription form, then send it to your Castor correspondent.

You will find the subscription form under “Documents”tab.

-

Contact your Castor correspondent in your company.

-

The minimum investment is the subscription price of one VINCI share.

The maximum payment cannot exceed 25% of your gross annual salaries and wages, barring any special conditions in your country.

-

The subscription price equals the average of the 20 quoted market price of the VINCI share prior to the beginning of the subscription period.

As VINCI shares are quoted in euros (€) at the Paris Stock Exchange, the reference price is therefore in euros (€).

For countries outside the eurozone, the subscription price is converted into the local currency at the exchange rate on the day before the start of the subscription period.

-

Log on to the online subscription site at Amundi and click “forgotten login details” then enter your e-mail address.

-

The offer is available for a limited subscription period, which opens once a year for three weeks. Subscription forms returned outside this period are not accepted.

-

The payment media are stated:

– on your subscription form,

– on the online subscription site at Amundi.

-

The share capital increase occurs a few weeks after the subscription period ends, the precise date of which is specified in the brochure of each share issue.

In this particular case, you do not qualify for bonus shares.

So there is no advantage in subscribing to this share issue.

-

After you subscribe, you will receive an account statement from Amundi ESR (Shareworks by Morgan Stanley for the United States) confirming your investment and your bonus share rights.

-

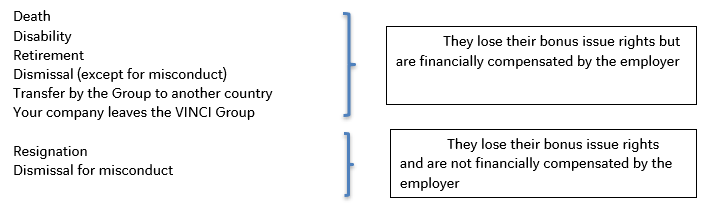

You will lose your bonus share rights if you leave the Group before the end of the vesting period (three years) or if you are transferred to another Group country.

If you resign, you will lose your bonus hare rights:

– on the day you send your letter of resignation;

– on the day that notice of termination is served;

– on the day you personally deliver your letter of resignation or notice.If you are dismissed for misconduct, your bonus share rights are lost on the day that notice of your dismissal is served.

Depending on the reason for your departure, you may or may not be financially compensated for this loss of bonus share rights. (For more information, see ”What happens to my bonus shares if I leave the Group before the end of the three-year vesting period (barring the special case of a fixed-term employment contract)”).On the other hand, you can no longer subscribe to future Castor International operation.

When I leave the Group, it is important that I check that my particulars are up to date (e-mail address, postal address, etc.).

-

In the Castor International plan, your savings are unavailable for three years from the date of the capital increase.

In certain cases, your savings may be released before the end of the vesting period. See ”What are the early release cases?” for more details.

-

– Death;

– Disability;

– Termination of the employment contract (retirement, resignation, dismissal, etc.);

– Your employer ceases to be a member of the VINCI Group;

– Inter Group transfer to another country.

Your request for early redemption can include both your available and unavailable savings.

-

Like any investment in shares, your Castor International savings are subject to rises and falls in the VINCI share price.

For countries outside the eurozone, you are also exposed to foreign exchange risk.

-

I lose my rights to the bonus shares.

Depending on the reason for my departure, I may or may not be financially compensated by my employer:

-

Your bonus share rights are not immediately cancelled at the end of your fixed-term employment contract, unless you request the release of your personal investment because of the termination of your contract.

After the three-year vesting period, there are two possible cases:– you are an employee of your company; the bonus shares are awarded to you;

– you are no longer employed by the company; you do receive neither bonus shares nor financial compensation.

-

Number of bonus shares initially calculated x initial subscription price of each operation.

Example: I retire in August 2019, so I can benefit from it.

I subscribed 10 shares in the 2017, 2018 and 2019 operations.

I am therefore entitled to 20 bonus shares for 2017, 20 bonus shares for 2018 and 20 bonus shares for 2019.

The 2017 subscription price was €77.67

The 2018 subscription price was €84.50

The 2019 subscription price was €88.08So my financial compensation will total:

(20x€77.67) + (20x€84.50) + (20x€88.08) = €1,553.40 + €1,690 + €1,761.60 = €5,005This compensation, which is paid by my employer when I leave, is generally treated as a wage and is thus liable for tax and social security contributions.

For countries outside the eurozone, this compensation is paid in the local currency.

-

Your savings become available and you receive VINCI bonus shares if you are still a Group employee and have kept your total initial investment.

You are then free to keep your VINCI shares in the Castor International group savings plan to sell some or all of them at any time.

-

You can consult the value of your savings at any time on Amundi or on your statement of account or on the “Monitor my savings” tab.

-

To recover your available savings, sign in to your online Amundi account or on the “How to release” tab.

To redeem your unavailable savings, contact your Castor correspondent.

-

On receipt of your instructions, Amundi ESR sells your holdings on the next market day on the basis of the VINCI share’s opening price at the Paris Stock Exchange.

Amundi ESR remits the payments to your company.

Your company receives the amount and forwards it to you on receipt.

Your company will receive the sum one to two weeks after your redemption request is executed.

-

Your savings are unavailable for three years from the date of your subscription. So you can only redeem your savings in cases of early release. See ”What are the early release cases?” for the various cases of early release.

-

In the vast majority of countries, subscribed shares are held through an employee’s mutual fund. An employee’s mutual fund is a portfolio of securities jointly held by all the employees who have a share of the mutual shares. When you take up the offer, you will not be a VINCI shareholder directly. You will therefore have Castor International employee’s mutual fund units.

When the regulations in certain countries do not allow this, VINCI shares are held directly.

-

The value of an employee’s mutual fund unit is fixed every day according to the opening price of the VINCI share at the Paris Stock Exchange.

The very slight difference between the value of an employee’s mutual fund unit and the VINCI share is accounted for by the fund’s running costs.

These running costs are less than 0.1% per annum.

-

It is governed by a supervisory board composed of employee and management representatives. The board’s remit is to represent the employee shareholders and exercise the voting rights attached to VINCI shares held by the employee’s mutual fund at general meetings.

All the duties of the supervisory board are explained in the mutual fund’s rule book available under the “Documents” menu on the Castor VINCI website.