Q&A

-

CASTOR, on an international scale and in France, is an employee shareholding plan of the VINCI Group. Its aim, wherever possible, is to allow you to become a VINCI shareholder on preferential terms.

The goal for VINCI is to share the benefits of our performance and to strengthen the sense of belonging to the VINCI Group.

-

A. Matching shares

Your employer will match the number of shares that you buy up to a maximum value of £1,500.

Buy 1 share and get 1 free up to £1,500.

No matching shares will be awarded for purchases from £1500 to £1800B. Tax and NI savings

The amounts you invest will be deducted from your gross pay, so you will benefit from tax and NI savings.

The matching shares will become yours 3 years after your initial investment if you are still employed by your company and you did not withdraw part or all of your shares.C. Dividends payment

As a shareholder, you receive dividends twice a year. Dividends paid by VINCI will be reinvested to provide extra shares for you.

D. Charges paid by your employer

No charges relating to joining fees, share purchases and the maintenance of your plan account. A transaction fee will be applied when you withdraw your shares.

-

You will be able to join the Plan if all of the following conditions apply to you:

– you have a contract of employment with a participating VINCI company;

– on the date that you join the plan you have been continuously employed by that company for at least six months; and

– you are a UK resident for income tax purposes.

-

Except in special cases, companies held by more than 50 % by VINCI are eligible to join this offer.

-

The participating countries in CASTOR INTERNATIONAL so far are:

Australia, Austria, Bahrain, Belgium, Brazil, Cambodia, Cameroon, Canada, Chile, Colombia,Croatia, Czech Republic, Dominican Republic, Estonia, Finland, Germany, Greece, Hong Kong, Hungary, Indonesia, Italy, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, Morocco, New Zealand, Norway, Netherlands, Peru, Poland, Portugal, Romania, Singapore, Slovakia, Spain, Sweden, Switzerland, United Arabic Emirates, United Kingdom, United States.

-

Two ways :

– Apply on line

– Print and complete the Share Agreement form and return it to your share plan administrators, Equiniti.

-

First check with your CASTOR co-ordinator to see if you are eligible to participate. If you are not yet eligible, you will receive your details when you become eligible. If you are eligible though, you should contact Equiniti’s helpline on 0371 384 2956.

-

You will need to contact Equiniti’s helpline on 0371 384 2956 to regain access to your online account.

-

You can choose to invest the same amount per week/per month (min £10 and max 10% of your gross pay)/or invest a single lump sum limited to £1800 or 10% of your gross annual salary.

You may change the amount at any time by contacting the Plan Administrator, Equiniti Limited.

You may stop the deduction at any time or begin them again by writing to your employer.

If you cease to be employed by a participating company your salary deductions must cease.

-

Shares will be purchased on the 15th of each month following the month in which pay deductions were made. For example, the shares arising from April’s deductions from pay will be purchased on 15th May. Shares will be purchased using the share price on each occasion that shares are purchased for you. Only whole shares will be purchased on your behalf – any unused balance of your pay deduction will be carried over from one month to the next. At the end of the annual subscription period, any unused balance will be repaid to you via Payroll, less tax and NI. Current share prices are available online at castor.vinci.com.

-

Deductions may be made from one month’s pay or spread over a number of months, from April to October inclusive.

You can join the Plan at any time from 1st March until 30th September. However, if you wish to join in time for the April deduction from your pay, you must apply no later than 23rd March.

-

The amount invested will be deducted from your gross pay.

It can be deducted weekly, monthly or in a single lump sum.

-

Yes, you can participate but depending the reason of your leaving, you may lose your matching shares and pay income tax and NI on the amount invested.

The Plan is designed for investing over at least 5 years.

-

If your employment ends, you will have to withdraw your shares.

-

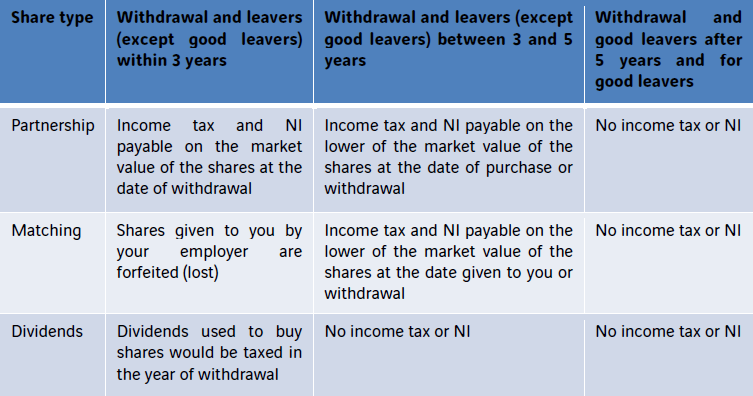

You may withdraw your shares at any time. The effect depends on how long you have held them and the reason for your employment ended:

If you resign or leave otherwise than in specified “good leaver” circumstances, income tax and NI will arise if you leave within 5 years, and you may forfeit your matching shares.

-

– Redundancy;

– Retirement;

– TUPE transfer;

– Death;

– Disability or Injury; or

– Your employer ceases to be an associated company.

-

As with all investments in shares, the value of your savings follows the price of VINCI’s stock, both up and down.

Your investment is also subject to currency exchange rate risk.

As VINCI’s shares are traded in Euros on the Paris stock exchange, the value of your shares will go up or down as the Pound moves against the Euro.

-

After three years, you retain your matching shares if you are still employed by your company and you did not withdraw part or all of your shares.

If you leave or sell your shares within 3 years, the matching shares will be taken back.

To optimize tax treatment, it is recommended to keep your investment 5 years.

-

You can check the value of your savings whenever you want on line or consult the tab « track my savings ».

-

To sell your shares, visit the website Equiniti

Or consult the tab « How to recover ».

-

Once your refund request has been received, Equiniti will sell your shares the next trading day (each Wednesday) based on the opening price of the VINCI share on the Paris stock exchange.

Equiniti generates payments to your company.

Please note that if you sell your shares within 5 years of your investment, your partnership and bonus shares will be subject to income tax and NI.

Your company will pay the amount refunded through your pay (after income tax and NI if necessary).

The time between the execution of the sale request and the actual payment can vary. If you are selling ‘available’ shares (i.e. those with no tax or NI liability), it can be as little as two weeks. If you are selling ‘conditional’ shares (i.e. those that do have tax and NI liability), they must be sent to your payroll department for processing – it will then be determined by their schedule when payment is made, this therefore could take up to 6 weeks.

-

As Shares are held by the Trustee, the Trustee will exercise voting rights upon the receipt of your direction in relation to a specific resolution or, absent such direction, based on the vote of the VINCI employee collective shareholding fund FCPE “CASTOR INTERNATIONAL”.